Teach teens financial fitness now so they have a prosperous future.

If we let students graduate high school without learning key skills like saving and budgeting, we’re doing them a real disservice. These budgeting activities are terrific for a life-skills class, morning meeting discussion, or advisory group unit. Give teens the knowledge they need to make smart financial choices now and in the future!

Before you get into the nitty-gritty of numbers, start with this clever activity that gives kids practice allocating assets in a low-stakes way. They’ll use jellybeans to decide what they need, want, and can truly afford.

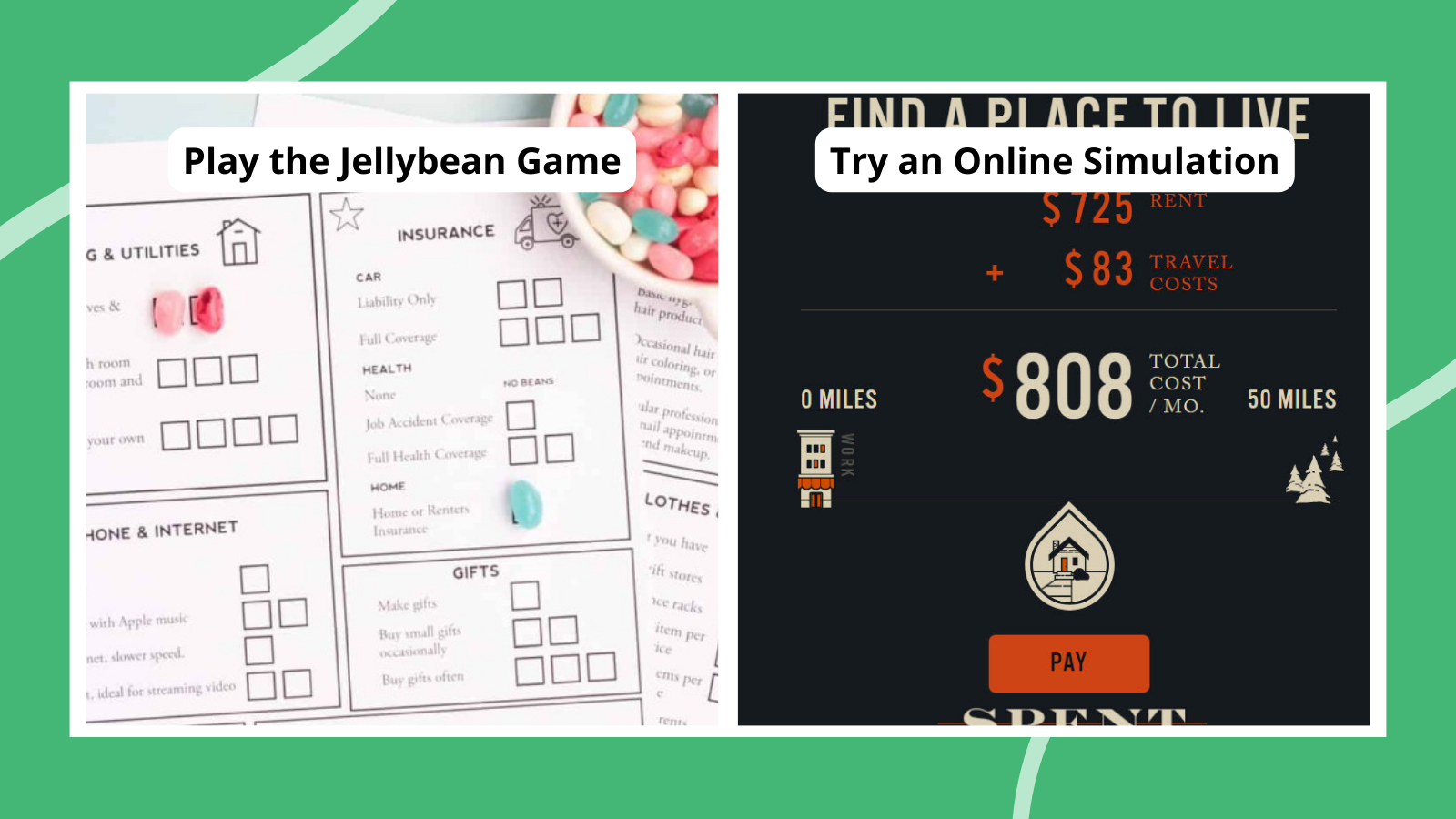

The Consumer Financial Protection Bureau has developed lots of tools to help teens and adults learn to manage money. Show kids how to use their Income Tracker, Spending Tracker, Bill Calendar, and Budget Worksheet (all at the link below). Start by having kids consider their current financial situation. Then, give them hypothetical “adult” situations to plan for, with income and expenses drawn from typical people in your area.

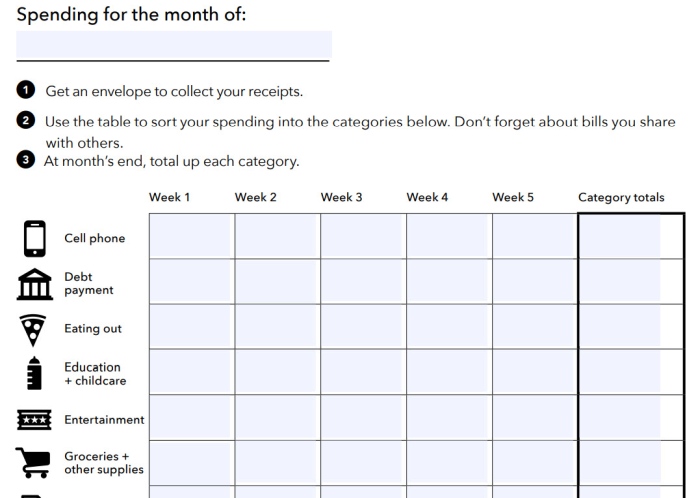

This activity encourages kids to think about purchases, especially major ones. Saving money is just one part of the process—they also need to consider what makes a good purchase and whether they should pay up front or borrow the money instead.

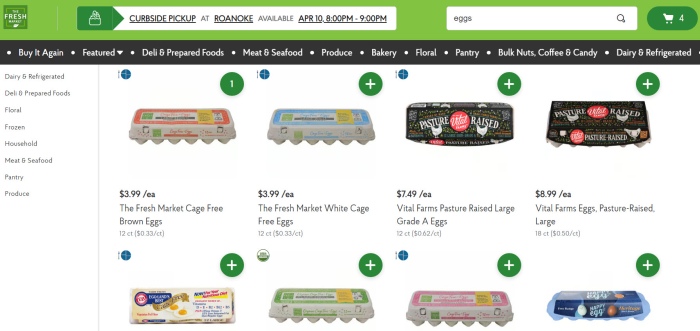

Most kids probably have no idea how much groceries cost. Use grocery store websites to your advantage, and have kids take a virtual shopping trip. They can plan meals and determine what they’ll need to buy. Or have them start with a weekly food budget and work backwards from there. Either way, remind them to make sure their menus include healthy options.

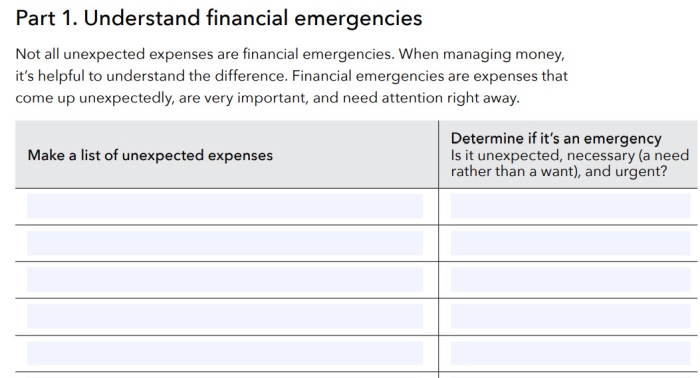

It’s no secret that things can and do go wrong. Budgeting activities like this one help students learn what to do when unexpected expenses crop up. Students learn about real-world costs and come up with ways to save in advance and adjust on the fly.

ADVERTISEMENT

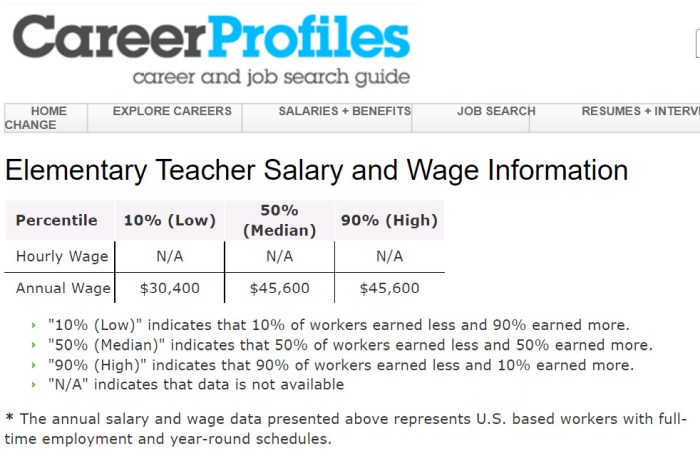

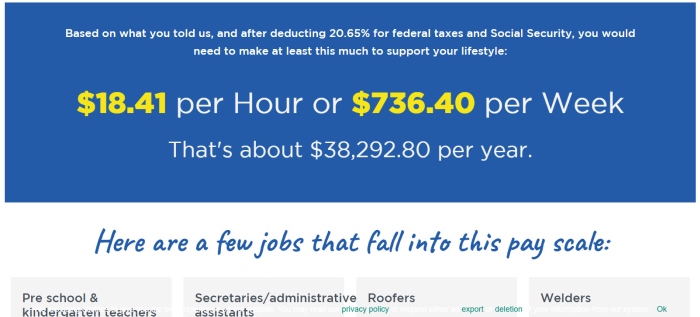

Ask students to list some jobs they think they’d like to do someday. Then, have them research average salaries for those jobs. Encourage them to factor in where they plan to live (salary ranges can be dramatically different across the country). Plus, ask them to think about the education they’ll need to land those jobs, and how long it will take them to earn the money to pay back any loans they’ll have to take.

These days, most people pay with plastic instead of cash. Sometimes they use debit cards, but often they’re credit cards. If you’re going to use them, you need to know how they work. Divide your class into groups, and ask each to research a different question about credit cards, like how they work, what interest they charge, and how to use them safely.

Learn more: Best Credit Cards at Money Under 30

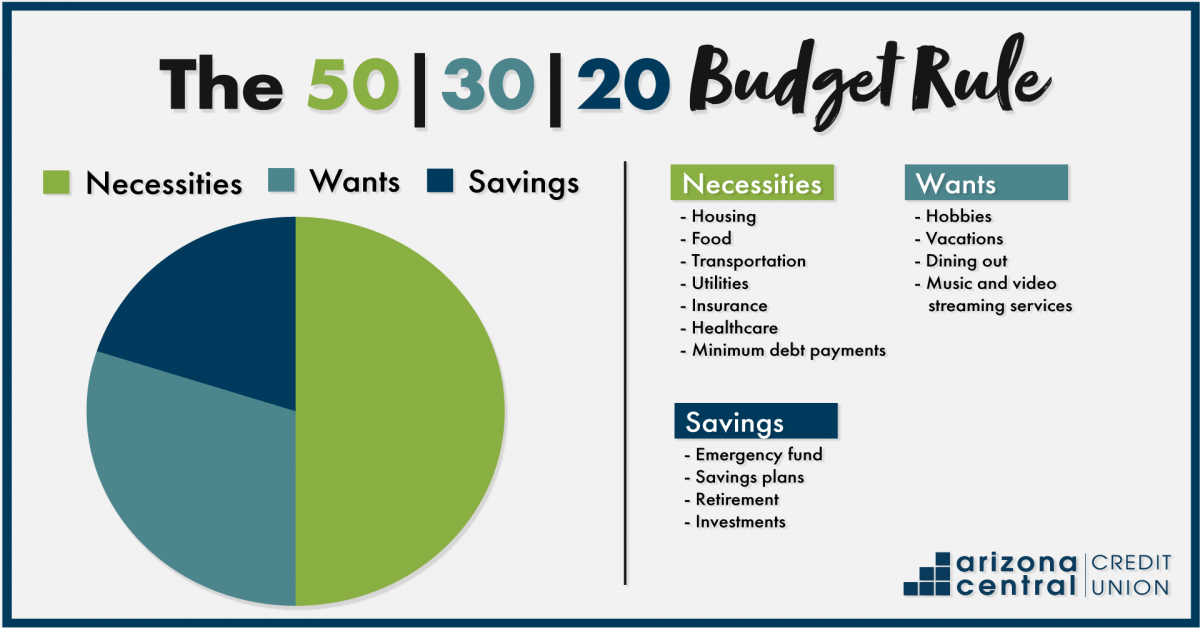

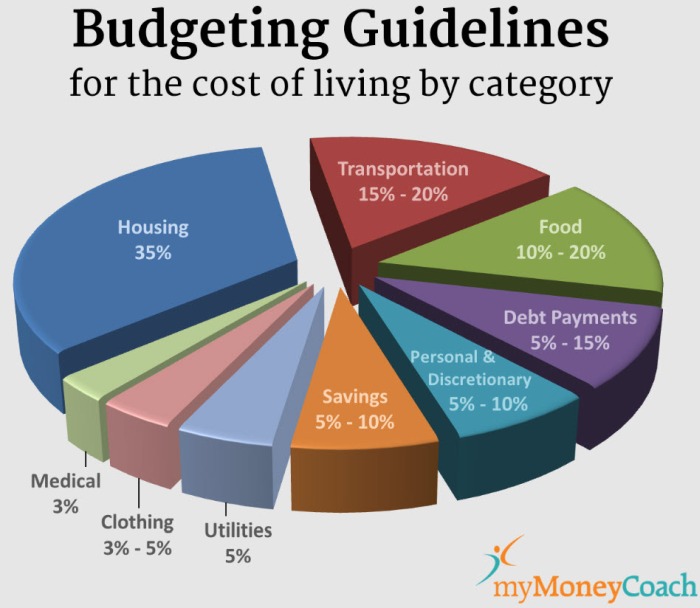

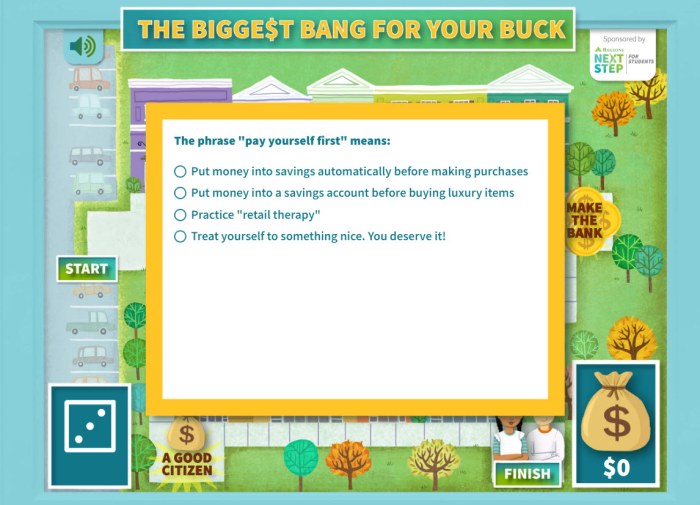

There’s no one right way to set up a budget. Expose students to a variety of models, like proportional budgets, the “pay yourself first” model, the envelope budget, and more. Ask them to think about which kind of person each model works best for and which one they’d choose.

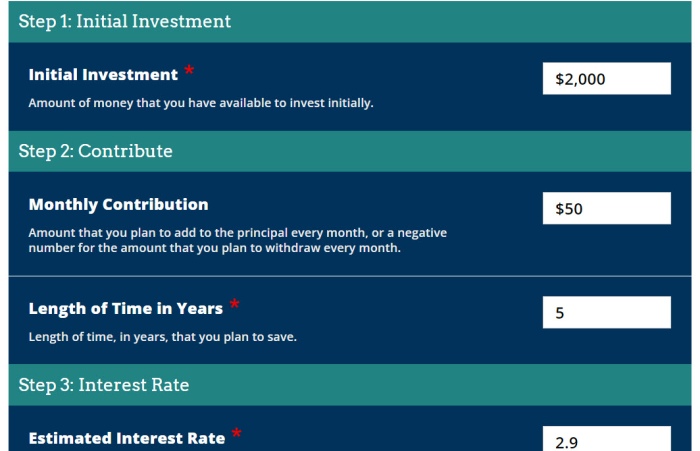

When you invest your money in an interest-bearing account, it earns money just by sitting there! That money can really grow over time too. Have students complete budgeting activities like looking up current interest rates and then calculating the potential interest from using those accounts for short and long periods of time. Explore local bank offerings, and take into account things like fees too.

Kids generally don’t think about all the costs of daily living. Start by brainstorming a big list as a class of all the things people need to spend money on each month: rent or mortgage, car payments, credit card payments, food, entertainment, utilities, Internet access, and more. Break kids into groups and have each group research the average costs of those items in your area. Come back together as a class and add up their findings to see what “living expenses” can really be.

Learn more: Monthly Expenses at Inspired Budget

Everybody’s got dreams, but how realistic are they? That’s where the Jump$tart Reality Check program comes in. By making choices about the future they want, teens will learn what they’ll need to earn to make it happen. The answers might really surprise them.

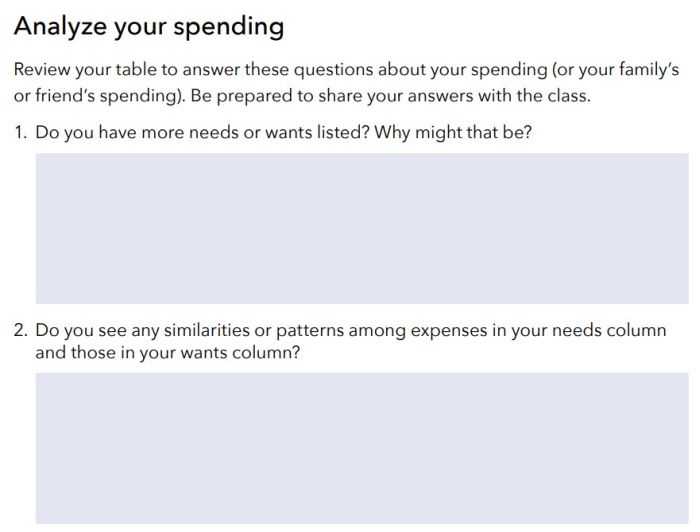

Ask students to reflect on what they truly need to survive vs. things that just make life easier or more fun. Budgeting activities like this can help them identify items they can eliminate when funds get really tight.

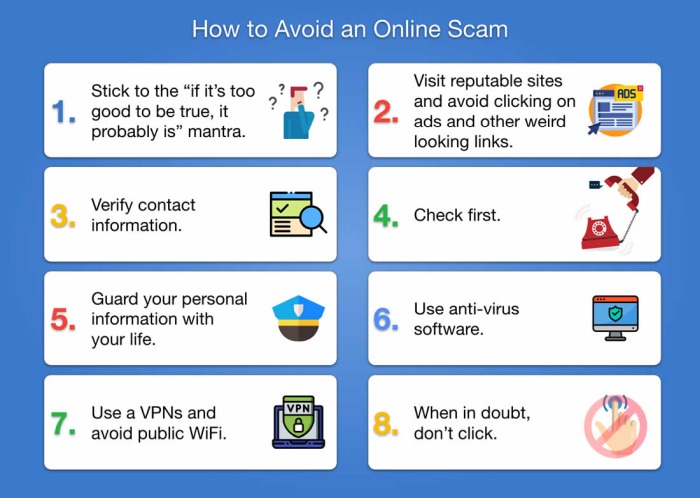

If teens don’t learn smart skills like avoiding phishing scams, how to choose good passwords, or identifying fraudulent sites, they can lose everything they save. Take time to learn about the most common fraud issues, and teach them how to be responsible online.

The title pretty much says at it all: By playing this game, students learn how to manage their money and use it responsibly.

Let students imagine life as an Uber driver. This game is based on actual Uber driver experiences and can be a real eye-opener.

Think of this like Oregon Trail for the modern age. A group of friends is setting off on a cross-country trip, but they’ve got to manage their funds to get where they want to go. Try this one as a group activity so kids have to work together to make smart choices.

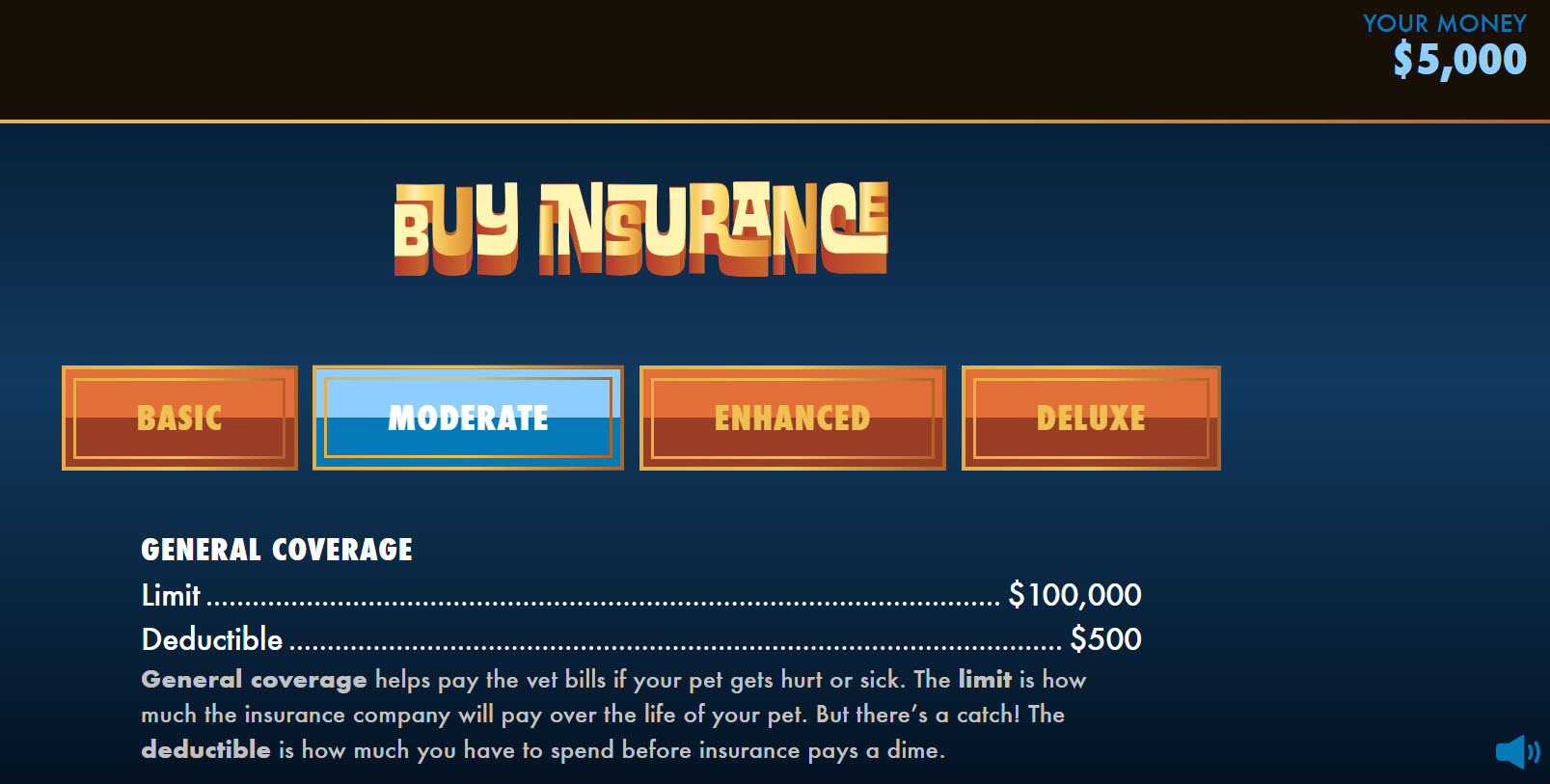

Budgeting and saving is important, but students should also learn about the importance of having the right kind of insurance. Because sometimes life really is just a bummer!

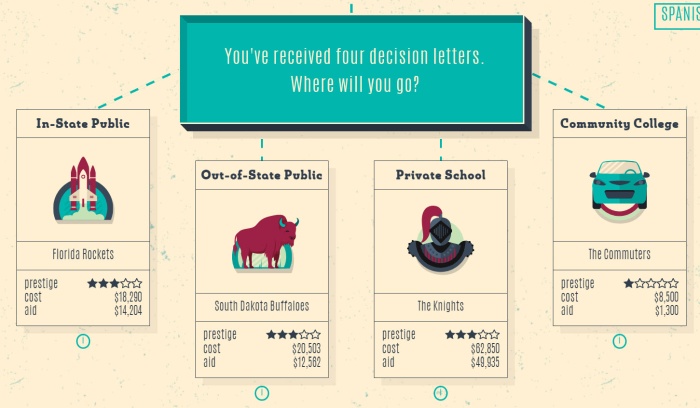

College-bound kids might figure they’ll take loans now and figure out how to pay them back later, but do they really have a handle on the true costs? These interesting online simulations let you pick your school, then walk through four years of potential expenses and income opportunities to find out how you fare in the end.

This online game feels a bit like a graphic novel, and it helps kids learn the basics of budgeting and money management. Explore multiple topics and complete missions to learn valuable skills.

a money management game for teens and tweens" width="702" height="468" />

a money management game for teens and tweens" width="702" height="468" />

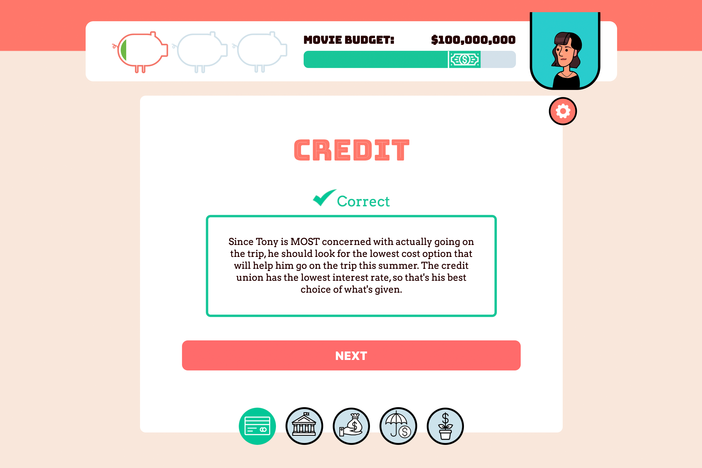

Managing your own money can feel a little dull, so why not try your hand at managing a multimillion-dollar movie budget instead? This one has levels for both middle and high school students too.

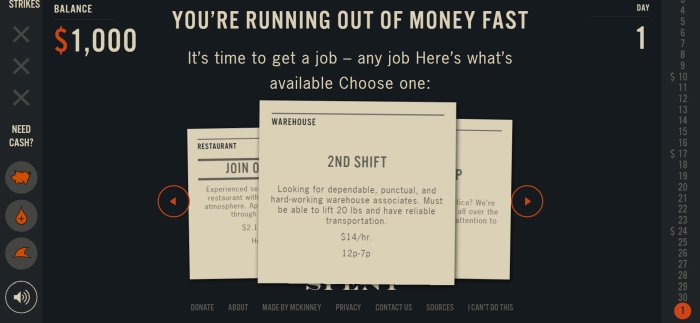

Living on the financial edge is a sad reality for so many people. Show kids what that can feel like with this online simulation. When the game starts, you have no housing and no job and just $1,000 in the bank. Can you get a job and make it to the end of the month?

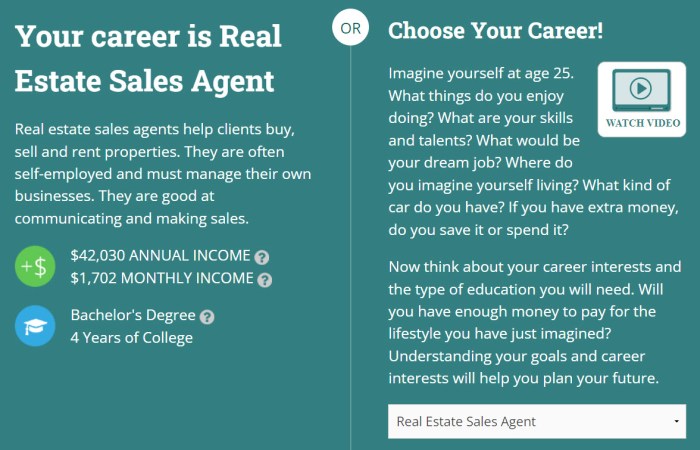

This cool online game assigns you a career (or lets you choose one) and tailors your experience to your location. You get to make choices about housing and other expenses, and the game calculates how those things fit into a responsible budget.

This online game guides kids through a shopping trip with financial literacy questions along the way. It’s simple but a terrific way to introduce a discussion on spending, saving, and budgeting.

For kids who are sure they can make enough money to live on with their social media accounts, this game might be a bit of a reality check.